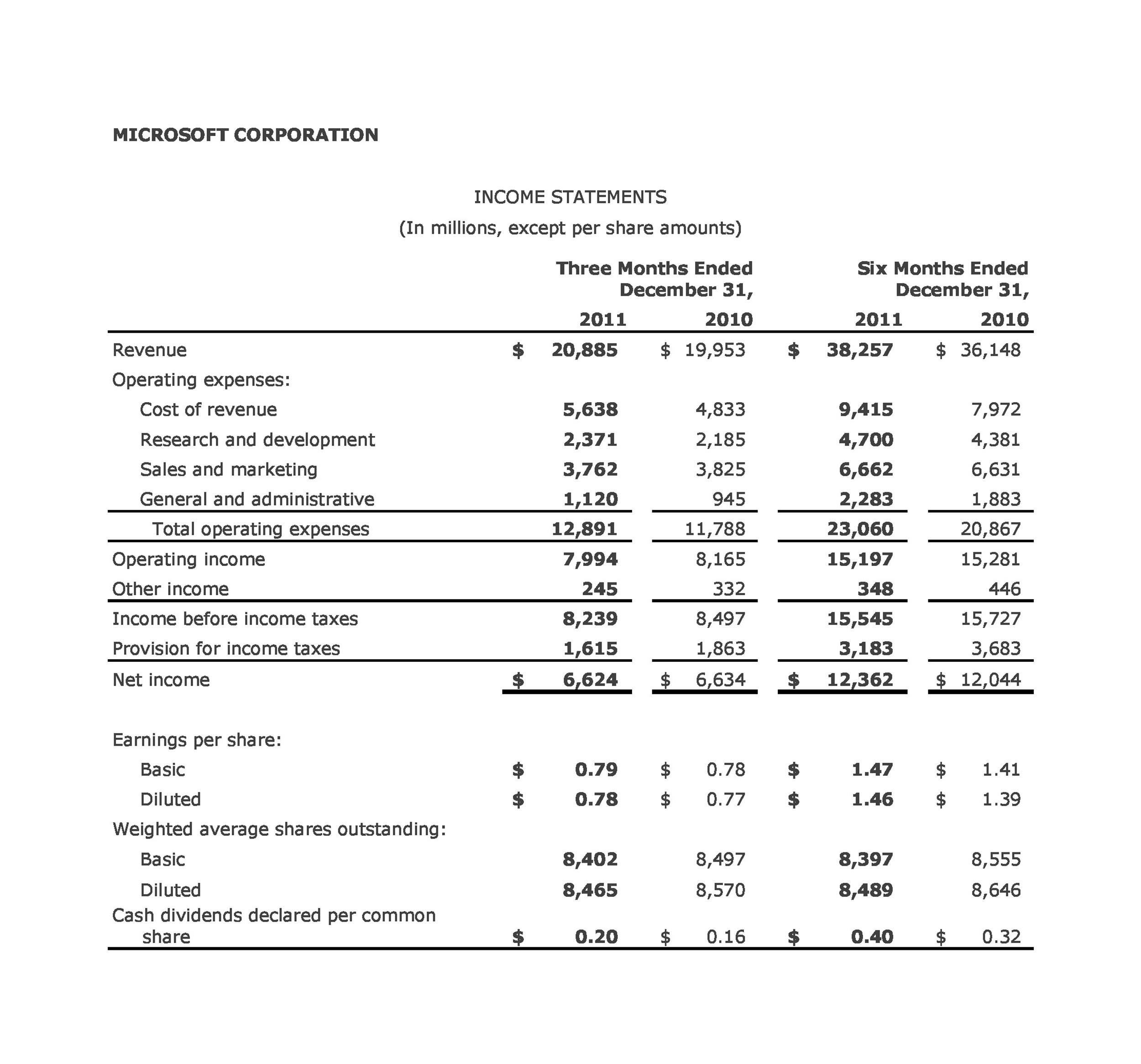

It can also be used to make decisions about inorganic or organic growth, company strategies, and analyst consensus. Examples of gains are proceeds from the disposal of assets, and interest income. It starts with the top-line item which is the sales revenue amounting to $90,000. 4 inventory costing methods for small businesses The illustration above comprehensively shows the different levels of profitability of XYZ Corporation. This is used to fund public services, provide goods for citizens, and pay government obligations. These include dividend income, and proceeds from sale of extraordinary items.

Other Key Financial Statements

It showcases the cost structure, helping management identify areas of inefficiency and opportunities for improvement. It offers a breakdown of revenues, expenses, and profits over a specific period, presenting a clear picture of the organization’s operational efficiency and profitability. This comprehensive document equips stakeholders with valuable insights into the company’s revenue sources, cost structure, and overall financial position. Understanding these variances is vital in financial analysis, as they provide insights into the operational efficiency and profitability of a company, aiding in informed decision-making. These differences highlight the need for a comprehensive understanding of financial statement terminology to accurately interpret and assess a company’s financial health. The primary purpose of an income statement is to convey details of profitability and business activities of the company to the stakeholders.

Why You Can Trust Finance Strategists

- It assists in strategic decision-making by identifying areas of strength and weakness, guiding resource allocation, and facilitating performance assessment.

- To get the contribution margin, the variable costs are subtracted from the revenue.

- A traditional income statement, also known as a profit and loss (P&L) statement, provides a snapshot of a company’s ability to make money.

- The income statement should be used in tandem with the balance sheet and cash flow statement.

- The four key elements in an income statement are revenue, expenses, gains, and losses.

Companies use the traditional income statements to establish external reporting while they use contribution margin income statements to analyze the performance of each category of product. Because of its approach, a traditional income statement can also be referred to as a full cost. In calculating variable costs, fixed production costs are not included in the cost of producing goods or services.

Key Takeaways

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Income statements can be complex, but understanding the different components is crucial to interpretation. It helps analysts and research houses analyze, forecast, and perform corporate valuation in order to create future economic decisions in the company.

All of our content is based on objective analysis, and the opinions are our own. All three documents must be reviewed together to get a clear picture of the financial health of the business. Income statements are generally used to serve as a reporting metric for various stakeholders. Expenses are how much it costs for a business to keep running and make money. After taking into account all non-operating items, the bottom line of the company showed $7,000 as net profit.

This format helps in understanding how much money is left after covering direct costs. Accountants refer to this report to decide how to reduce costs or increase income. It shows if the company is making more money than it spends or if it needs to fix something to stop losing money. The traditional income statement is a vital financial tool that provides a comprehensive overview of a company’s financial performance over a specific period. In this article, we will delve into the intricacies of traditional income statements, including their components, differences from contribution margin income statements, advantages, limitations, and a real-life example. In a traditional income statement, expenses are categorized by function, such as cost of goods sold, selling, general, and administrative expenses.

This is because lenders want to know the ability of the company to generate revenue and profit, as well as its capacity to repay the loan. Losses can be the result of one-time or any other extraordinary expenses, or lawsuit expenses. We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Please refer to the Payment & Financial Aid page for further information. HBS Online’s CORe and CLIMB programs require the completion of a brief application.

The income statement is one of the three important financial statements used for reporting a company’s financial performance over a set accounting period. The other two key statements are the balance sheet and the cash flow statement. The contribution margin income statement is an alternative to the traditional income statement. The difference is that this profit and loss statement separates the variable and fixed expenses involved in running a business. Then, at the end of the contribution margin income statement, we can obtain the revenue after deducting or paying all the fixed and variable expenses and costs.