A very important issue to note is that the button used to place the order does not change colour regardless if you’re buying or selling, so always pay close attention to which order type you select. Additionally you’ll be able to set a take-profit order, a stop-loss order or make your buy/sell order a limit order only using price values. The sum volume of all transactions executed during a specific time period.

TRUSTED PAYMENT PROVIDERS

Here you’ll be able to quickly create a trading order using either quantity in Lots, in currency value or in required margin. As you can see, Alvexo’s spreads are far more expensive than even some of the most expensive (in terms of spreads) brokers out there. Within Alvexo, the word “expensive” gets a whole new definition of its own. Their spreads are amongst the highest we have ever observed in the industry even if you choose to deposit $50,000 to get access to a “Prime” account. The following video will teach you how to read a candlestick chart – A must have skill for online traders.

What are forex trading signals?

Market makers compete for clients by offering reduced transaction costs. They contribute to a market’s liquidity by facilitating transactions. The difference between the given interest and the base interest on an adjustable-rate mortgage, or 4.

- Having a wide range of supported payment methods ensures that a maximum possible number of customers are satisfied with the broker.

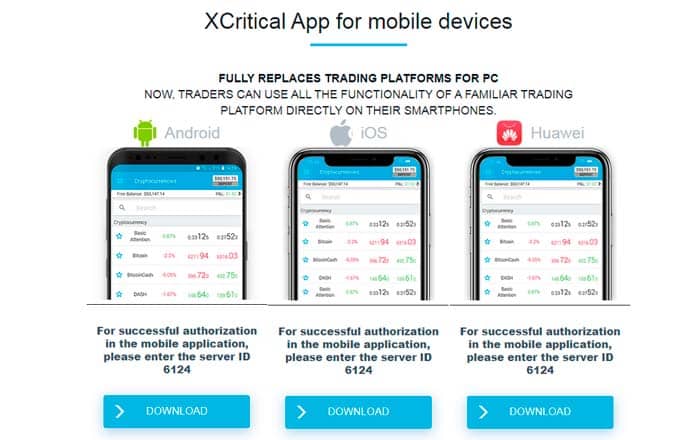

- You can access real-time market quotes and price feeds, view charts and manage positions from the palm of your hands on both Android and iOS devices.

- These have been prepared by their team of professional economists, analysts and brokers.

- There are fixed spreads, variable spreads and some that are a mixture of both.

- The company is a member of the Investor Compensation Fund (ICF) and is subject to maintaining minimum capital requirements.

Access financial market instruments, globally

With an Elite Account, you enjoy spreads from 0.1 pips and can trade European, US, and Cannabis stocks – as well as bonds. Additionally, you get to enjoy an unlimited number of support sessions. However, your minimum deal size will now be increased to 0.25 lots. Aware of the reality that some traders might find it more convenient to trade on an app instead of a web-based trading platform, Alvexo has developed its very own mobile-based trading platform too. The app is equipped with the latest features and can be downloaded on both Android and Apple devices.

Trading with the MT4 Webtrader

In terms of markets, I found the range of instruments to be reasonable but not as substantial as top brokers like Swissquote who have thousands of tradeable assets. You can trade contract for differences (CFDs) on around 450 instruments in multiple asset classes including from Forex, Commodities, Cryptocurrency, Stocks, Shares, Indices, Metals, Energies, Bonds & CFDs. The main advantage of trading CFDs is that you can go long (buy) or short (sell) without needing to own the underlying asset. You are simply speculating on whether you think the price will rise or fall. You can choose from a selection of intuitive trading platforms all of which stream real time buy and sell quotes on over 450 different assets. I found the platforms to be flexible and user friendly, with a range of trading tools that are great for assisting with your market analysis.

You can customise the platform to be as simple or complex as you need it to be. This makes it a popular choice of platform for both new and experienced traders alike. Alvexo are known for the education that they provide along with their service-oriented focus for all levels of traders.

When is the forex market open for trading?

An order used to minimize losses if the value of a security starts moving in a position opposed to the desired – resulting in the position losing value. The position is automatically closed if it reaches the value determined by the order. The amount of securities sold at that price will usually be specified alongside. A middle-market (mid-market) company is one whose revenues are between $10 million and $1 billion.

A CFD, or Contract for Difference, is an instrument with which traders speculate on the price movement of various assets like stocks, commodities or currencies. The contract does not relate to an actual exchange of goods, only the payment of the difference between opening and closing prices over a specified span of time. For example, say a trader is speculating on the price of livestock, and he believes that due to a recent disease epidemic in New Zealand sheep, prices will rise as supply gets cut. Unlike an investor, who usually maintains possession of the instrument for the long-term, traders usually trade assets or derivatives at a faster rate, entailing higher transaction costs. A demo account enables beginners to learn about the broker’s platform and the different financial instruments offered in a risk-free environment.

A person (or agency) that arranges and/or negotiates a transaction between the parties to that transaction (buyer – seller), to be distinguished from an agent, who acts on behalf of one of the parties. The glossary contains an A-Z of of popular trading terms along with an explanation of each. It can be very important to familiarise yourself with the most commonly used trading terminology. Alvexo EU is a brand name of VPR Safe Financial Group Limited who are committed to protecting clients’ interests and security, in accordance with governing rules and guidelines. They are focused on providing a personalised and reliable service whilst implementing the latest advanced innovative technologies to ensure you can trade in a safe and powerful trading environment.

Depending solely on the type of account you hold, your spread rates will vary drastically. For example, for the same instrument such as American Airlines Group stocks – your spread can be from 0.6, 0.35, or even 0.1 pips depending on whether you are a Classic, Gold, Prime, or Elite client. It’s a term that represents the decentralized market for foreign currency trading. Also termed ‘FX’, investors in the forex market trade currency pairs like USDJPY, with the value of the pair determined by the exchange rate between the US Dollar and Japanse Yen, in this case. This includes commissions for brokers, banks, agents, search, appraisal and government tariffs, and spreads – the difference between the cost of an instrument and the final price paid by the buyer.

You can get access to a wide range of educational materials in their dedicated trading academy, including trading guides and video tutorials. These have been prepared by their team of professional economists, analysts and brokers. If you are a beginner, you alvexo forex broker will find these very helpful to get you started. If you already have some experience then I don’t think you will find anything new here. The signals I received were based on logical reasoning but they would require your own additional money management.

Another aspect of the broker that impressed me was that they have a great choice of flexible accounts to cater for individual trader’s needs. The account type that you opt for will determine your trading conditions and the duration of the services available to you. Thus, it is imperative to choose an account that best reflects your trading budget and requirements. Alain Baradhi, from the United Arab Emirates, spells out in all caps “DO NOT TRUST” Alvexo because he claims that the company is a scam and “fake”.

Hedge fund managers will typically offset riskier investments with low-risk instruments or assets with matching derivatives. In technical analysis, resistance lines on a price chart indicate the level that the price of an instrument will have difficulty rising above. Resistance (and support) lines may indicate future https://forexbroker-listing.com/ price levels of interest, especially in the case of prices crossing them. Opening a transaction – initiating a transaction – that will later be closed, the relative prices at both points dictating profit or loss on that transaction. As a measurement, it is the ratio between speed of sale and going price.

Developed by trading software company MetaQuotes, MT4 is the industry’s leading trading platform with millions of users worldwide. I think it has a quick learning curve which could make it a good option for beginners. You will find a vast range of built in tools for performing in-depth market analysis.

The difference between the buy (bid) and sell (ask) prices – the moneychanger’s or broker’s profit. The difference between the price of a trade and what was expected. In Forex, this usually refers to when limit or stop loss orders are executed at a worse rate – usually as a result of unexpected news or market volatility. As their value increases due to the increased demand created by the central bank, their yield drops and the supply of money increases without requiring the printing of money.

Contract for Difference; a derivative contract between a buyer and a seller, wherein the seller will pay the buyer the difference between an asset’s current value and its value at a defined closing time. If the ask price reaches the specified level, a long position is opened. Bitcoin is a virtual or digital currency – part of an online financial exchange system that is based on the transfer of encrypted information between users over the internet. Rates, terms, products and services on third-party websites are subject to change without notice. We may be compensated but this should not be seen as an endorsement or recommendation by TradingBrokers.com, nor shall it bias our broker reviews.

The value of a group of selected stocks, used to describe their market and compare returns on investment. Since a stock index is a mathematical concept, it cannot actually be directly invested in per se. However, some mutual funds and ETFs (exchange-traded funds) follow the percentage change of specific indices. Global indices follow large companies, regardless of location, whereas national indices follow the performance of national stock markets, usually selecting the major local companies traded on that market.

Congress with maximizing employment, stabilizing prices and maintaining long-term interest rates. It also conducts federal monetary research and policy, regulates banking institutions and provides monetary services to other financial institutions and U.S. government agencies. Economic data (usually macroeconomic) that indicate the health of an economy and its financial market. The most pertinent are those released on a regular basis by government agencies regarding inflation, GDP, employment and prices of major commodities (such as crude oil).